Valued at a market cap of $126.4 billion, Medtronic plc (MDT) develops, manufactures, and sells device-based medical therapies to healthcare systems, physicians, clinicians, and patients. The Galway, Ireland-based company is scheduled to announce its fiscal Q3 earnings for 2026 before the market opens on Tuesday, Feb. 17.

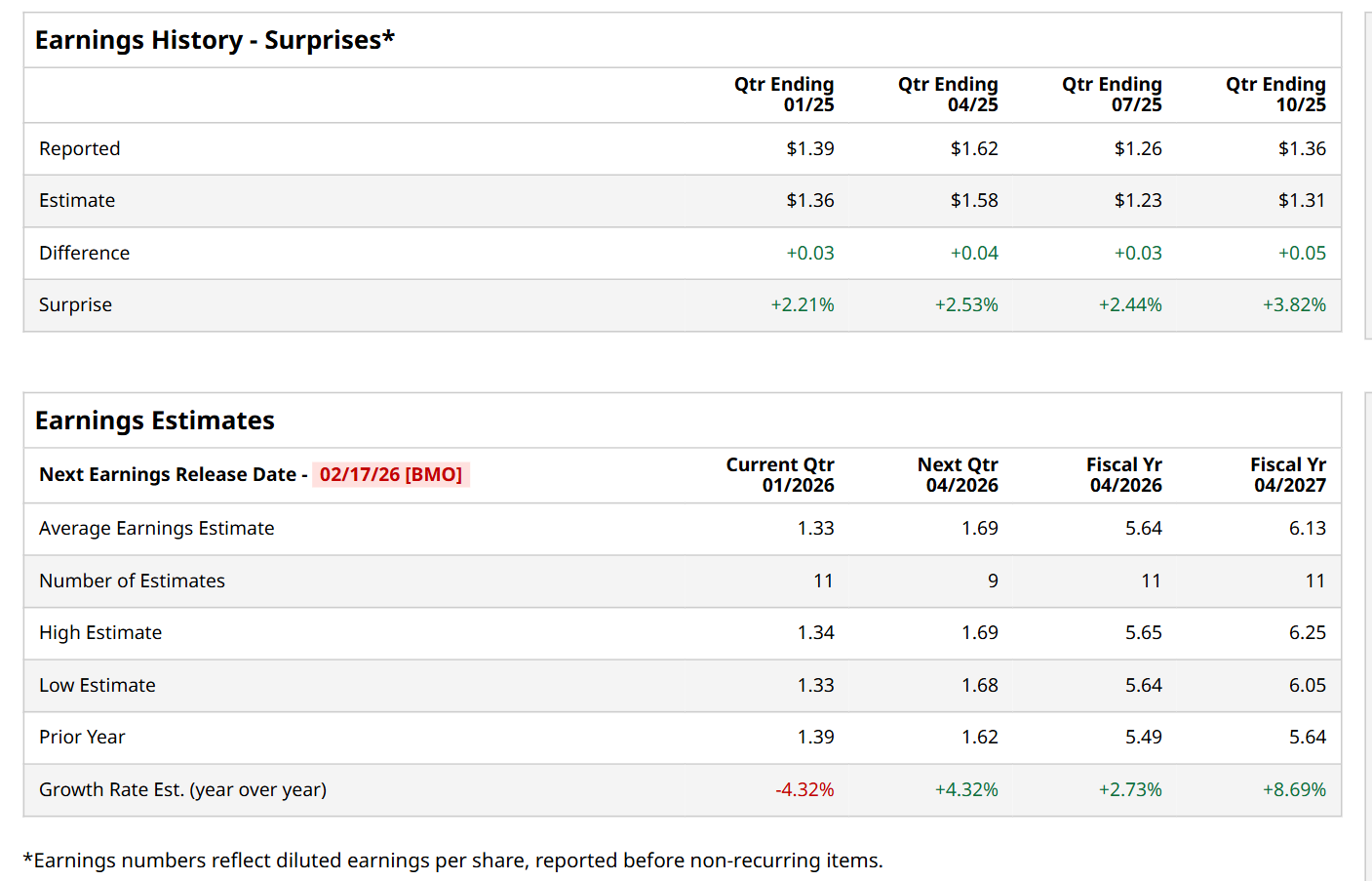

Ahead of this event, analysts expect this healthcare company to report a profit of $1.33 per share, down 4.3% from $1.39 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters. Its earnings of $1.36 per share in the previous quarter topped the consensus estimates by 3.8%.

For fiscal 2026, ending in April, analysts expect MDT to report a profit of $5.64 per share, up 2.7% from $5.49 per share in fiscal 2025. Its EPS is expected to further grow 8.7% year-over-year to $6.13 in fiscal 2027.

MDT has slightly lagged behind the S&P 500 Index's ($SPX) 13.7% return over the past 52 weeks, with its shares up 13.5% over the same time frame. However, zooming in further, it has outpaced the State Street Health Care Select Sector SPDR ETF’s (XLV) 11.1% uptick over the same time period.

On Nov. 18, shares of MDT surged 4.7% after reporting better-than-expected Q2 results. Due to strong growth in revenue across all its business segments, the company's overall revenue increased 6.6% year-over-year to $9 billion, surpassing consensus estimates by 1.1%. Moreover, its adjusted EPS of $1.36 also grew 7.9% from the year-ago quarter, topping analyst expectations of $1.31. Additionally, MDT raised its fiscal 2026 revenue growth and EPS guidance, reinforcing its momentum and further bolstering investor confidence.

Wall Street analysts are moderately optimistic about MDT’s stock, with an overall "Moderate Buy" rating. Among 27 analysts covering the stock, 11 recommend "Strong Buy," one suggests a "Moderate Buy,” and 15 indicate "Hold.” The average price target for MDT is $110.71, indicating a 10.4% potential upside from the current levels.

On the date of publication, Neharika Jain did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The ‘Trump Effect’ Makes Intel’s Earnings Report Tonight Very Special. Why You Should Brace for a Double-Digit Move in INTC Stock.

- As SoFi Stock Drops Below $30, Is it a Buy Ahead of Q4 Earnings?

- AMD Stock Outperformed Nvidia. Is It Still a Buy?

- Dear Boeing Stock Fans, Mark Your Calendars for January 27