Over the past six months, Amentum has been a great trade, beating the S&P 500 by 11.7%. Its stock price has climbed to $29.15, representing a healthy 26% increase. This was partly due to its solid quarterly results, and the run-up might have investors contemplating their next move.

Is there a buying opportunity in Amentum, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free for active Edge members.

Why Is Amentum Not Exciting?

We’re happy investors have made money, but we're cautious about Amentum. Here are three reasons why AMTM doesn't excite us and a stock we'd rather own.

1. Long-Term Revenue Growth Disappoints

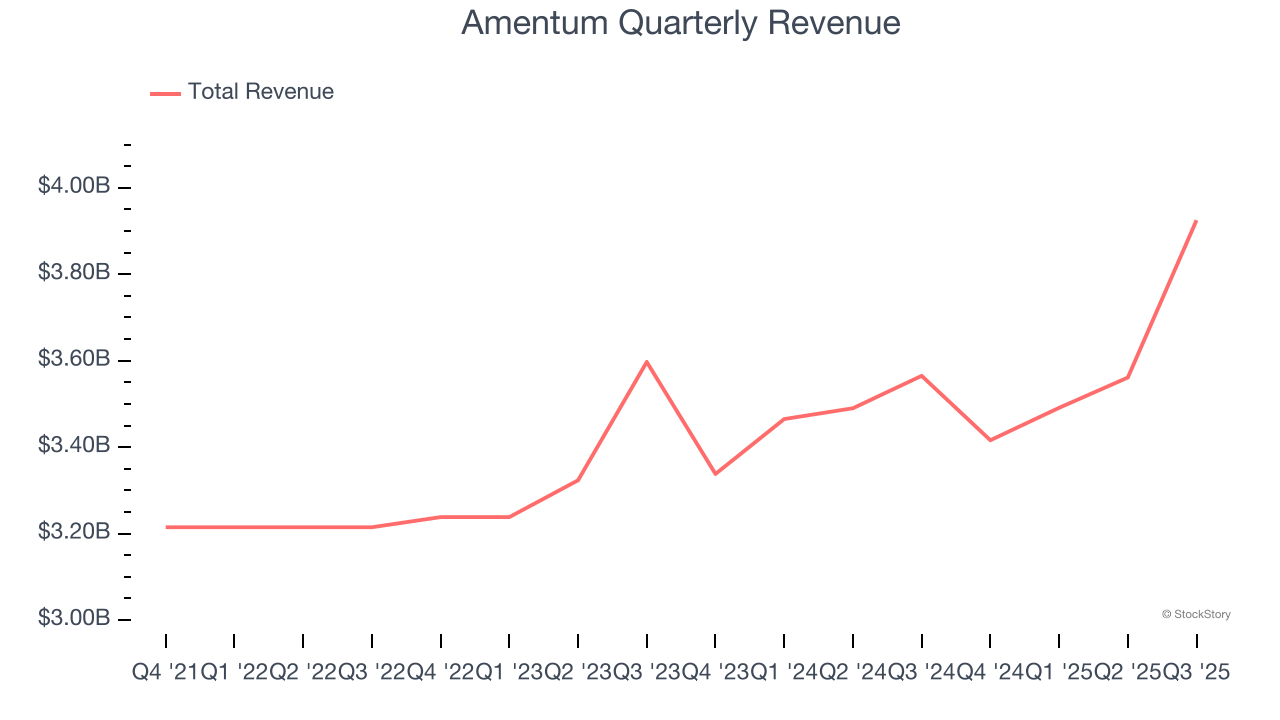

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Unfortunately, Amentum’s 2.4% annualized revenue growth over the last three years was sluggish. This was below our standards.

2. Revenue Projections Show Stormy Skies Ahead

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Amentum’s revenue to drop by 1.5%, a decrease from its 2.4% annualized growth for the past three years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

3. Previous Growth Initiatives Haven’t Impressed

Growth gives us insight into a company’s long-term potential, but how capital-efficient was that growth? A company’s ROIC explains this by showing how much operating profit it makes compared to the money it has raised (debt and equity).

Amentum historically did a mediocre job investing in profitable growth initiatives. Its five-year average ROIC was 3.7%, lower than the typical cost of capital (how much it costs to raise money) for business services companies.

Final Judgment

Amentum’s business quality ultimately falls short of our standards. With its shares outperforming the market lately, the stock trades at 12× forward P/E (or $29.15 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are superior stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.