Meta Platforms, Inc. - Class A Common Stock (META)

644.86

-15.71 (-2.38%)

NASDAQ · Last Trade: Mar 6th, 10:31 PM EST

Detailed Quote

| Previous Close | 660.57 |

|---|---|

| Open | 647.90 |

| Bid | 641.30 |

| Ask | 641.50 |

| Day's Range | 636.11 - 649.47 |

| 52 Week Range | 479.80 - 796.25 |

| Volume | 13,159,564 |

| Market Cap | 1.86T |

| PE Ratio (TTM) | 39.44 |

| EPS (TTM) | 16.4 |

| Dividend & Yield | 2.100 (0.33%) |

| 1 Month Average Volume | 13,009,963 |

Chart

About Meta Platforms, Inc. - Class A Common Stock (META)

Meta Platforms Inc is a technology company that focuses on building and connecting social media platforms and virtual experiences. It is best known for its flagship products, which include Facebook, Instagram, and WhatsApp, providing users with a space to communicate, share content, and engage with diverse communities. The company is also heavily invested in the development of augmented reality and virtual reality technologies, aiming to create immersive environments and enhance social interaction in the metaverse. Through its various platforms and initiatives, Meta seeks to empower individuals and businesses while fostering new ways for people to connect and collaborate. Read More

News & Press Releases

Nvidia has been the belle of the quarterly earnings ball for quite some time.

Via The Motley Fool · March 6, 2026

According to a report from Bloomberg, Oracle and OpenAI’s fallout has created room for Meta to consider leasing the site.

Via Stocktwits · March 6, 2026

As we move through the first quarter of 2026, the financial world is witnessing what many analysts describe as the most ambitious infrastructure buildout in human history. A collective "Big Four" spending spree, led by tech titans Microsoft, Amazon, and Meta, is projected to pour a staggering $650 billion into

Via MarketMinute · March 6, 2026

As the artificial intelligence arms race accelerates into 2026, Dell Technologies (NYSE:DELL) has firmly established itself as the backbone of the global infrastructure build-out. Shares of the Round Rock, Texas-based tech giant soared to new all-time highs this week following an earnings report that showcased a staggering $15.2

Via MarketMinute · March 6, 2026

SAN JOSE, Calif. — Two days after its high-stakes fiscal first-quarter earnings release, the financial world is still vibrating from the shockwaves sent by Broadcom Inc. (NASDAQ:AVGO). On March 4, 2026, the semiconductor and software giant reported a "beat and raise" performance that has fundamentally redefined the leadership hierarchy of

Via MarketMinute · March 6, 2026

Despite delivering a staggering "blowout" fourth-quarter earnings report that exceeded even the most bullish Wall Street forecasts, NVIDIA (NASDAQ: NVDA) has found itself navigating a period of intense volatility. In the days following its February 25, 2026, financial disclosure, the semiconductor giant witnessed a sharp 14.2% decline from its

Via MarketMinute · March 6, 2026

Broadcom Inc. (NASDAQ: AVGO) has once again cemented its status as a cornerstone of the global artificial intelligence buildout, reporting fiscal first-quarter 2026 results that blew past Wall Street expectations. The semiconductor giant revealed a staggering 74% year-over-year surge in AI chip revenue, a figure that underscores the industry’s

Via MarketMinute · March 6, 2026

In the annals of financial history, few dates carry the weight of May 22, 2024. It was the day NVIDIA (NASDAQ: NVDA) reported its Q1 FY2025 earnings, a "blockbuster" event that transcended mere financial reporting to become a cultural and economic inflection point. At the time, NVIDIA announced a staggering 262% year-over-year revenue increase and [...]

Via Finterra · March 6, 2026

Billionaire investors notably pared down their exposure to Meta Platforms in the fourth quarter in favor of an industry-leading chip fabricator that's thriving as artificial intelligence (AI) evolves.

Via The Motley Fool · March 6, 2026

GetHookd has launched AI tools for Facebook Ads audience and budget scaling, offering digital marketers competitive intelligence, AI-generated creative, and performance tracking capabilities for 2026.

Via Press Release Distribution Service · March 5, 2026

GetHookd has announced the release of an AI-powered platform for e-commerce brands featuring a range of creative and analytical features.

Via Press Release Distribution Service · March 5, 2026

GetHookd has announced enhancements to its AI-powered ad research platform, giving ecommerce brands and marketers expanded access to high-converting Facebook ad examples.

Via Press Release Distribution Service · March 5, 2026

As the global demand for artificial intelligence infrastructure enters a new, more intensive phase, Ciena (NYSE:CIEN) has positioned itself at the epicenter of the hardware revolution. In its latest financial disclosures released this week, the networking giant confirmed an ambitious revenue target for fiscal year 2026, projecting a range

Via MarketMinute · March 5, 2026

In the opening months of 2026, the technology sector witnessed a dramatic "tale of two tapes." Driven by monumental breakthroughs in autonomous "agentic" AI from Meta Platforms Inc. (NASDAQ: META) and the private heavyweight Anthropic, tech stocks initially surged to record highs, fueled by the promise of AI that could

Via MarketMinute · March 5, 2026

The semiconductor giant Nvidia (NASDAQ: NVDA) found itself at the center of a market storm this week as its stock plummeted 5.5% in a single trading session, despite delivering what analysts called a "triple beat" in its fiscal fourth-quarter earnings report. The drop, which occurred on February 26, 2026,

Via MarketMinute · March 5, 2026

In a trading session defined by red ink and rising geopolitical anxieties, Broadcom Inc. (NASDAQ: AVGO) emerged as a singular beacon of resilience. The semiconductor giant saw its shares climb 4.8% on March 5, 2026, a sharp divergence from a broader market that buckled under the weight of escalating

Via MarketMinute · March 5, 2026

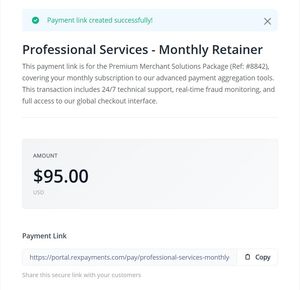

RexPayments, a leading global payment processor aggregator trusted by over 2,000 merchants, today announced the launch of Payment Links . This versatile new feature allows businesses to accept payments instantly through shareable, secure URLs, bypassing the need for a complex e-commerce checkout or dedicated website integration.

Via Get News · March 5, 2026

The "sell the news" fever that has gripped AI-adjacent technology stocks claimed its latest victim on March 5, 2026. Ciena Corp (NYSE: CIEN), a leader in optical networking and the "plumbing" of the modern internet, saw its stock price plunge over 14% in heavy intraday trading. This sharp decline came

Via MarketMinute · March 5, 2026

As the closing bell approaches on March 5, 2026, all eyes on Wall Street are fixed on Marvell Technology (NASDAQ:MRVL), which is set to report its fiscal fourth-quarter 2026 earnings after the market close. In a trading session characterized by heightened sensitivity to artificial intelligence (AI) capital expenditure, Marvell

Via MarketMinute · March 5, 2026

As the first quarter of 2026 draws to a close, a seismic shift in investor sentiment has fundamentally reshaped the landscape of the New York Stock Exchange and the Nasdaq. After three years of relentless enthusiasm for artificial intelligence software and generative models, the market has entered what analysts are

Via MarketMinute · March 5, 2026

In addition to their impressive stock price rises over the years, each of these disruptive tech companies puts some money directly into their shareholders' pockets.

Via The Motley Fool · March 5, 2026

As of March 5, 2026, the technology sector is undergoing a massive "Second Wave" of growth, driven by a fundamental shift from experimental artificial intelligence to the deployment of autonomous "AI Agents." This transition, spearheaded by recent breakthroughs from Meta and Anthropic, has catalyzed a significant market rebound, pushing the

Via MarketMinute · March 5, 2026

The global credit markets have delivered a resounding vote of confidence in the future of artificial intelligence, as Alphabet Inc. (NASDAQ: GOOGL) successfully raised $20 billion through a massive U.S. dollar bond sale that saw investor demand exceed $100 billion. The offering, which closed in late February and has

Via MarketMinute · March 5, 2026

Broadcom Inc. (NASDAQ: AVGO) delivered a powerful signal to the financial markets on March 4, 2026, reporting fiscal first-quarter earnings that surpassed analyst expectations and underscored its pivotal role in the second wave of the artificial intelligence (AI) revolution. As the market entered 2026, investors were laser-focused on whether the

Via MarketMinute · March 5, 2026